Dynamic Pricing: A Delicate Balance Between Profit and Customer Satisfaction 💰🎢

Introduction

Dynamic pricing, also known (implemented as) as real-time pricing or surge pricing, is a revenue management strategy that allows businesses to adjust prices based on fluctuations in supply and demand. This concept is rooted in the airline industry, where airlines have long employed dynamic pricing models to maximize revenue by adjusting fares based on travel dates, seat availability, and customer demand. 🛫

✈️For example, if a flight from New York to Los Angeles is in high demand, the airline may increase the ticket prices to capitalize on the strong demand. Conversely, if the flight has low occupancy, the airline may lower prices to attract more passengers and fill the remaining seats. This strategy aims to optimize revenue by aligning prices with market conditions.

The Rise of Dynamic Pricing and Surge Pricing

The advent of digital technologies and data analytics has enabled companies across various industries to adopt dynamic pricing strategies. Ride-sharing platforms like Uber popularized the term “surge pricing,” where fares increase during periods of high demand, such as rush hours or major events. 🚗💨 This approach incentivizes more drivers to get on the road, ensuring a better balance between supply and demand.

Wendy’s Reverses Course on Dynamic Pricing

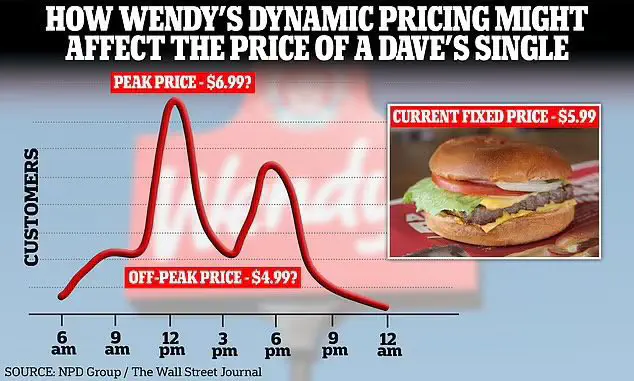

Recently, The Wendy’s Company, a fast-food chain, faced backlash after testing dynamic pricing in some locations. The company had planned to charge higher prices during peak hours, but customers expressed frustration with the perceived unfairness of the practice. In response, Wendy’s abandoned the dynamic pricing strategy, citing the importance of maintaining customer trust and loyalty. 🍔🚫

Lessons for Consumers

Dynamic pricing can be a double-edged sword for consumers. While it may offer opportunities to snag discounted prices during low-demand periods, it can also lead to higher costs during peak times. Consumers should be aware of these pricing strategies and plan their purchases accordingly. Additionally, transparency in businesses' pricing models is crucial to maintaining trust and avoiding customer backlash. 👀💭

Practical Tips for Managers

Before implementing dynamic pricing, managers should carefully consider the following factors:

- Customer Perception: Customers perceive Dynamic pricing as unfair or manipulative. Managers must weigh the potential revenue gains against the risk of damaging customer trust and loyalty. 🤝

- Competitive Landscape: Monitoring competitors' pricing strategies is essential to maintain a competitive edge and avoid pricing themselves out of the market. 🔍

- Data Analytics: Robust data analytics capabilities are crucial for accurately forecasting demand patterns and adjusting prices accordingly. Investing in advanced analytics tools and expertise can pay dividends. 📊💻

- Transparency and Communication: Communicating pricing policies and rationales to customers can help mitigate negative perceptions and foster trust. Transparency is key. 🗣️💬

- Legal and Ethical Considerations: Managers must ensure dynamic pricing practices comply with relevant laws and regulations, particularly in industries with strict pricing guidelines. Ethical considerations, such as fairness and non-discrimination, should also be addressed. ⚖️🧭

Dynamic pricing is a powerful revenue management tool, but it requires careful implementation and consideration of customer perceptions, competitive dynamics, and ethical implications. By striking the right balance, businesses can leverage dynamic pricing to optimize revenue while maintaining customer trust and loyalty. 🔑💰

#DynamicPricing #RevenueManagement #SupplyChain #CustomerExperience #DataAnalytics #EthicalBusiness

Note: A classical reading for Dynamic Pricing is a book “The Theory and Practice of Revenue Management” by Kalyan T. Talluri and Garrett J. van Ryzin (2006)

References:

Talluri, K. T., & Van Ryzin, G. J. (2006). The theory and practice of revenue management (Vol. 68). Springer Science & Business Media.